Main Tenang, Gampang Menang, Raih JP Maxwin Hari Ini di STADIUM77!

Dapatkan angka keberuntungan untuk permainan Anda!

REKOMENDASI PASANG ANGKA HARI INI

STADIUM77 merupakan platform yang memberikan peluang emas untuk meraih Maxwin di setiap permainan. Dengan sistem akses yang adaptif dan andal, STADIUM77 memastikan pengalaman bermain slot online tetap lancar tanpa gangguan, bahkan saat terjadi kendala pada jalur utama.

Sistem adaptif pada STADIUM77 memungkinkan koneksi yang tetap stabil meskipun ada perubahan dalam kondisi jaringan. Dengan pendekatan yang dinamis, platform ini dapat menjaga performa optimal selama permainan, memastikan pemain tetap dapat meraih kemenangan tanpa kendala, baik pada trafik tinggi maupun kendala teknis lainnya.

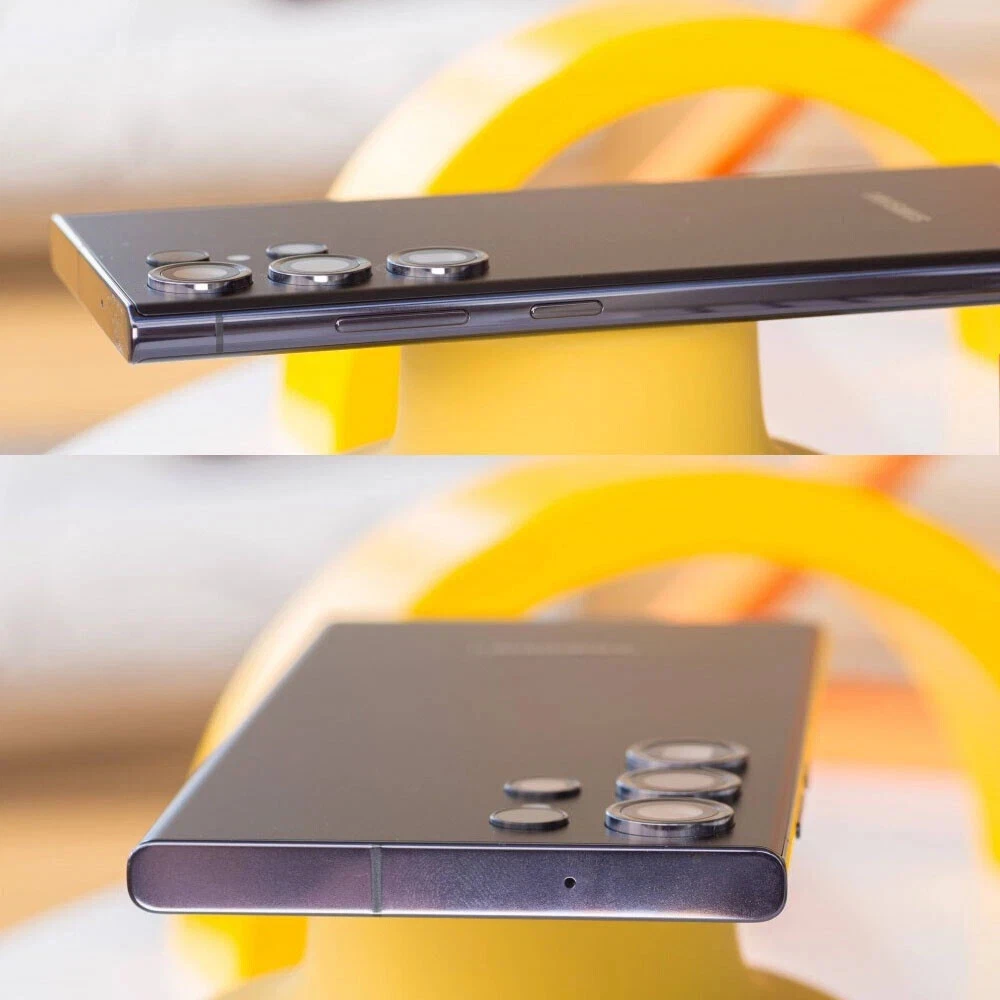

Tidak hanya itu, STADIUM77 juga memiliki arsitektur yang efisien, mempermudah pengguna untuk terhubung ke permainan slot online dengan cepat. Infrastruktur yang kuat mendukung koneksi stabil di berbagai perangkat, sehingga pengguna bisa merasakan pengalaman bermain yang konsisten dan menyenangkan.

Dengan kombinasi sistem adaptif, konektivitas berkelanjutan, dan desain yang efisien, STADIUM77 menjadi pilihan utama bagi mereka yang ingin bermain slot online tanpa gangguan. Platform ini menawarkan pengalaman yang tak terlupakan, menjaga kualitas layanan, dan membantu Anda meraih Maxwin di setiap permainan.

Refresh your browser window to try again.